Comprehending the Foreign Earned Income Exclusion and Its Influence On Your Typical Deduction

The Foreign Earned Revenue Exclusion (FEIE) supplies substantial benefits for migrants, enabling them to leave out a portion of their foreign-earned earnings from united state taxes. Nevertheless, asserting the FEIE can complicate one's tax scenario, particularly regarding the common deduction. Recognizing this interaction is essential for individuals living abroad. As migrants navigate these intricacies, they need to think about exactly how their selections impact their general tax responsibility. What strategies can they use to optimize their economic results?

What Is the Foreign Earned Earnings Exclusion (FEIE)?

The Foreign Earned Earnings Exclusion (FEIE) functions as a crucial tax obligation advantage for united state people and resident aliens working abroad. This arrangement enables qualified people to leave out a considerable section of their foreign-earned revenue from U.S. tax, effectively lowering their total tax problem. The FEIE intends to ease the economic pressure on expatriates and urges Americans to seek job opportunity in international markets. The exemption uses to incomes, wages, and specialist costs gained while living in a foreign country. The optimal exemption amount is adjusted each year for rising cost of living, ensuring that it remains pertinent to existing financial problems. By using the FEIE, expatriates can preserve even more of their earnings, fostering financial security while living overseas. Generally, the FEIE plays an essential duty fit the financial landscape for Americans abroad, facilitating a smoother change to international job environments and advertising economic involvement on a worldwide range.

Qualification Requirements for the FEIE

Qualification for the Foreign Earned Earnings Exclusion (FEIE) rests upon meeting specific standards set by the Irs (INTERNAL REVENUE SERVICE) Mostly, individuals need to be united state residents or resident aliens who gain income while staying in an international nation. To qualify, they need to please a couple of key tests: the Physical Visibility Test or the Authentic Residence Examination.

The Physical Existence Test calls for individuals to be literally existing in an international nation for a minimum of 330 complete days within a 12-month duration - FEIE Standard Deduction. Alternatively, the Authentic Home Examination requires that individuals develop residency in an international country for a nonstop duration that consists of an entire tax year

Furthermore, the revenue must be obtained from individual solutions performed in the foreign nation. Fulfilling these requirements permits taxpayers to leave out a considerable part of their foreign-earned income from U.S. taxation, thus minimizing their overall tax obligation obligation.

Just how to Declare the FEIE

To begin the process, people need to collect documents that validate their foreign incomes, such as pay stubs, income tax return from international countries, and any type of relevant work contracts. It is vital to ensure all income asserted under the FEIE is gained from international resources and satisfies the needed limits.

Furthermore, taxpayers must think about submitting deadlines and any kind of possible extensions. Asserting the FEIE properly not only aids in decreasing tax obligation liability yet additionally ensures conformity with internal revenue service guidelines. Appropriate documents and adherence to guidelines are crucial for a successful claim of the Foreign Earned Earnings Exclusion.

The Interaction In Between FEIE and Conventional Reduction

The communication in between the Foreign Earned Income Exemption (FEIE) and the basic reduction is an essential facet of tax obligation preparation for migrants. Recognizing the basic concepts of FEIE, along with the restrictions of the conventional reduction, can considerably affect tax filing techniques. This section will explore these components and their implications for taxpayers living abroad.

FEIE Basics Explained

While many expatriates look for to lower their tax obligation burden, understanding the interaction between the Foreign Earned Earnings Exemption (FEIE) and the conventional reduction is important. The FEIE allows united state citizens and resident aliens living abroad to omit a specific amount of international earned income from united state tax. that site This exclusion can significantly lower gross income, possibly affecting qualification for various other deductions, such as the conventional deduction. Remarkably, people that assert the FEIE can not also take the standard reduction versus the left out revenue. Because of this, expatriates must meticulously evaluate their overall revenue and deductions to maximize their tax circumstance. Awareness of these interactions can bring about more informed economic decisions and far better tax techniques for migrants steering via their special scenarios.

Criterion Deduction Limitations

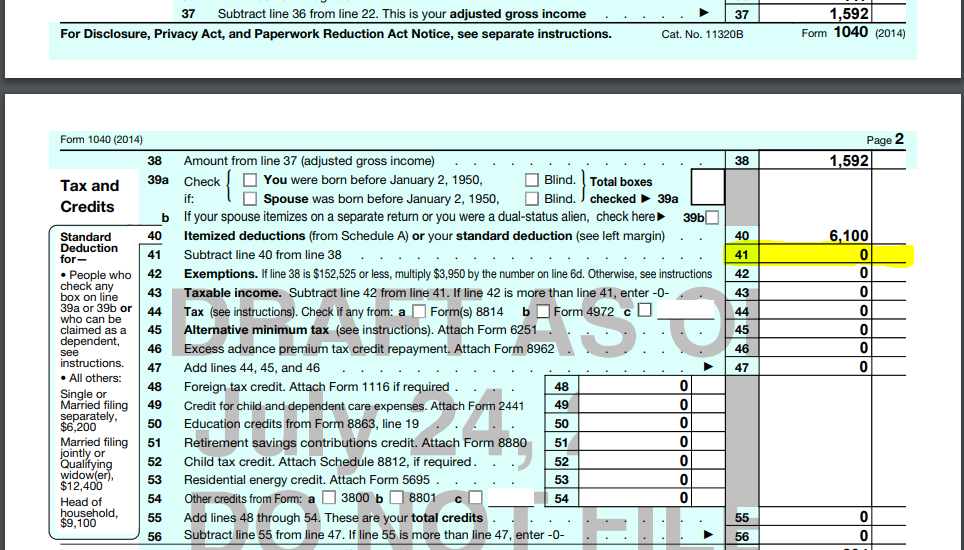

Recognizing the limitations of the basic reduction in connection with the Foreign Earned Earnings Exclusion (FEIE) is essential for expatriates navigating their tax responsibilities. While the FEIE permits certifying people to omit a particular quantity of foreign-earned earnings from U.S. tax, it can influence the standard deduction they are eligible to insurance claim. Specifically, taxpayers that claim the FEIE can not likewise assert the standard deduction on that omitted revenue. In addition, if a migrant's overall revenue drops below the conventional deduction limit, they might not take advantage of it whatsoever. This interaction necessitates cautious preparation to optimize tax obligation advantages, as underutilizing the common deduction can lead visit this web-site to greater gross income and enhanced tax obligation responsibility. Recognizing these restrictions is critical for efficient tax obligation technique.

Tax Filing Effects

Maneuvering the tax obligation filing effects of the Foreign Earned Earnings Exclusion (FEIE) requires cautious factor to consider of exactly how it connects with the conventional reduction. Taxpayers making use of the FEIE can omit a considerable section of their foreign-earned revenue, but this exemption impacts their eligibility for the standard reduction. Particularly, if a private claims the FEIE, they can not likewise assert the common deduction for that earnings. This can bring about a lower total tax obligation obligation but might make complex the declaring process. Additionally, taxpayers should ensure compliance with IRS demands when submitting Kind 2555 for the FEIE. Understanding these communications is crucial for enhancing tax advantages while staying clear of potential pitfalls in the filing process. Mindful preparation can take full advantage of advantages and decrease obligations.

Potential Tax Obligation Ramifications of Utilizing the FEIE

The Foreign Earned Revenue Exclusion (FEIE) offers considerable tax benefits for U.S. citizens functioning abroad, however it additionally comes with prospective effects that require careful consideration. One significant effect is the effect on qualification for particular tax obligation credit scores and reductions. By electing to use the FEIE, taxpayers might inadvertently minimize their modified gross earnings, which can limit access to credit scores like the Earned Income Tax Credit history or lower the amount of conventional reduction available.

Furthermore, people that utilize the FEIE may deal with complications when returning to the united state tax obligation system, particularly worrying the taxation of future earnings. The exemption applies only to gained revenue, indicating various other earnings types, such as dividends or rate of interest, continue to be taxed. This difference necessitates precise record-keeping to ensure compliance. Ultimately, the FEIE may influence Resources state tax obligation obligations, as some states do not identify the exemption and may tire all revenue earned by their citizens, no matter of where it is made.

Tips for Optimizing Your Tax Benefits While Abroad

While working abroad can be enhancing, it additionally provides one-of-a-kind opportunities to optimize tax obligation advantages. To make best use of these advantages, individuals ought to first determine their eligibility for the Foreign Earned Revenue Exclusion (FEIE) and take into consideration the physical visibility examination or the bona fide house examination. Maintaining comprehensive records of all revenue earned and costs sustained while overseas is vital. This paperwork supports claims for credit ratings and reductions.

In addition, comprehending the tax treaties in between the United States and the host country can assist stay clear of dual taxes. Individuals must also check out payments to tax-advantaged accounts, such as IRAs, which might offer further reductions.

Last but not least, speaking with a tax obligation professional focusing on expatriate tax obligation legislation can supply tailored approaches and guarantee compliance with both U.S. and international tax obligation commitments. By taking these steps, migrants can effectively improve their financial circumstance while living abroad.

Frequently Asked Concerns

Can I Make Use Of FEIE if I Help an International Government?

Yes, an individual can use the Foreign Earned Income Exemption (FEIE) while benefiting a foreign government, given they meet the requisite problems laid out by the IRS, consisting of the physical visibility or authentic residence tests.

Does FEIE Apply to Self-Employment Revenue?

The Foreign Earned Revenue Exemption (FEIE) does put on self-employment income, supplied the private meets the essential demands. Eligible independent individuals can leave out certifying income gained while living in a foreign country from taxation.

What if My International Earnings Surpasses the FEIE Restriction?

If international earnings exceeds the FEIE limitation, the excess amount may be subject to U.S. taxes. Taxpayers should report and pay tax obligations on the income over the exemption threshold while still taking advantage of the exclusion.

Can I Declare the FEIE and Itemize Reductions?

Yes, individuals can assert the Foreign Earned Earnings Exclusion (FEIE) while also itemizing reductions. They have to be conscious that asserting the FEIE might influence the accessibility of particular itemized reductions on their tax return.

Exactly How Does FEIE Affect My State Tax Obligations?

The Foreign Earned Revenue Exemption can minimize state tax obligations, as several states adhere to federal guidelines. Nonetheless, specific state policies vary, so it's important to get in touch with state tax regulations for particular implications on tax obligation responsibilities.

The Foreign Earned Revenue Exemption (FEIE) supplies significant advantages for migrants, enabling them to exclude a part of their foreign-earned earnings from U.S. tax. While lots of migrants look for to reduce their tax problem, understanding the interaction between the Foreign Earned Income Exemption (FEIE) and the basic deduction is essential. Understanding the limitations of the standard reduction in relationship to the Foreign Earned Earnings Exemption (FEIE) is essential for expatriates steering their tax obligation obligations. The exemption applies only to gained income, suggesting various other earnings kinds, such as dividends or rate of interest, remain taxable. The Foreign Earned Revenue Exemption (FEIE) does apply to self-employment revenue, supplied the specific satisfies the necessary requirements.